Is ESG Investing Making a Difference?

ESG investing is wildly popular – but is it actually changing business?

“ESG” is no longer just a buzzy financial acronym – it’s become an essential component of companies’ strategies for planning, growth and business development. While positive environmental, social and governance (ESG) qualities were “nice to have” traits for companies in the past, they’re rapidly becoming essential for businesses who want to capture market share and investors’ dollars. The demand for ESG-oriented business practices is growing – but are these mounting expectations leading to actual change in how companies do business?

A Growing Crescendo: The Rise of ESG

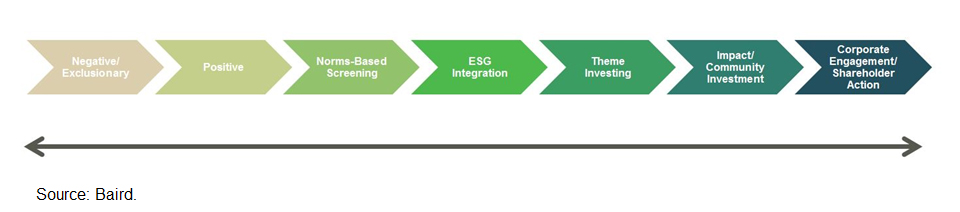

In the past, social impact-minded investors often took a passive or exclusionary approach to vetting their investments. Investing options have matured since then, and today there is an entire continuum of socially responsible investing (SRI) options that adhere to ESG factors:

SRI and ESG-oriented strategies are gaining traction among investors. Inflows to such funds are growing even as overall equity fund flows decline. According to research from the Forum for Sustainable and Responsible Investment, almost $12 trillion in investments were in SRI strategies at the start of 2018, and nearly $5.6 trillion of assets under management incorporated ESG principles, a 3.7x increase over 2005 levels.

What’s more, ESG investing isn’t a localised trend – it’s becoming increasingly popular in markets across the globe. “Sustainable” investments account for an increasing share of professionally managed financial assets around the world. According to the 2018 Global Sustainable Investment Review, Europe leads the globe with €12.3 trillion, or 49% of assets under professional management committed to sustainable and responsible strategies.

How is ESG Investing Changing the Business World?

The growing focus on ESG issues and desire for responsible investing options is being driven by investors, particularly those in younger generations. There is a growing appetite for socially aware policies and business practices such as building a sustainable supply chain and the recyclability of materials.

Investors are bringing that hunger for “better” business to the investment vetting process. Some are even publicly committing to responsible investing principles. The United Nations Principles for Responsible Investment (PRI) champions responsible investing across the globe, and more than 2,450 investment managers, asset owners and service providers have signed the PRI. The signatories represent more than $82 trillion in assets under management.

Today’s investors are demanding a new level of accountability from the companies they’ve invested in, and they’re letting them hear it. Current shareholders sometimes express these desires in very public forums. For example, in early 2019 both Chevron and Exxon faced multiple investor proposals at their annual meetings that demanded answers on a number of climate and disclosure topics.

Private investors are also demanding more information on a company’s relationships, business practices and ethics before placing their bets. Instead of screening out specific businesses or industries, ESG-minded investors are now proactively examining current and potential investments for good behavior. They’re performing due diligence on a company’s governance structure and track record, working practices, supply chain behaviours and more. These investors are focused on backing companies that make a difference, treat their employees well and protect the environment.

Improving Transparency and Reporting

While there is no standard reporting protocol for ESG measures, there is movement in a positive direction – and as such, the quality of data available to investors is improving. Entities like the International Integrated Reporting Council and Sustainability Accounting Standard Board are helping to turn the tide on reporting quality. The Global Reporting Initiative, which launched in 2000, sets sustainability benchmarks that are now used by 80% of the world’s largest companies. Additional standards such as the EU’s Guidelines for Sustainable Investing aim to facilitate investor-company dialogue.

What About Returns?

A growing body of evidence points to a relationship between sustainability initiatives and strong business results. A 2015 meta-study from the University of Oxford showed that companies with better sustainability practices tended to have better operational performance and often superior stock price performance relative to companies rated lower for ESG. A study published in the Quarterly Journal of Economics identified a strong, positive relationship between good corporate governance – specifically, strong shareholder rights – and higher profits. These companies also had higher company values, stronger sales growth, lower capital expenditures and made fewer acquisitions. And with more evidence of a strong correlation between business performance and sustainability initiatives, ESGs seem to be here to stay.

This content was produced by the advertising department of the Financial Times, in collaboration with Baird.

Robert W. Baird Limited is authorised and regulated in the UK by the Financial Conduct Authority and affiliated with Robert W. Baird & Co. Incorporated.